NZ Interactive Media Industry Survey 2023

19 December 2023

New Zealand video games sector proves resilient with 7% growth, despite Australian incentives

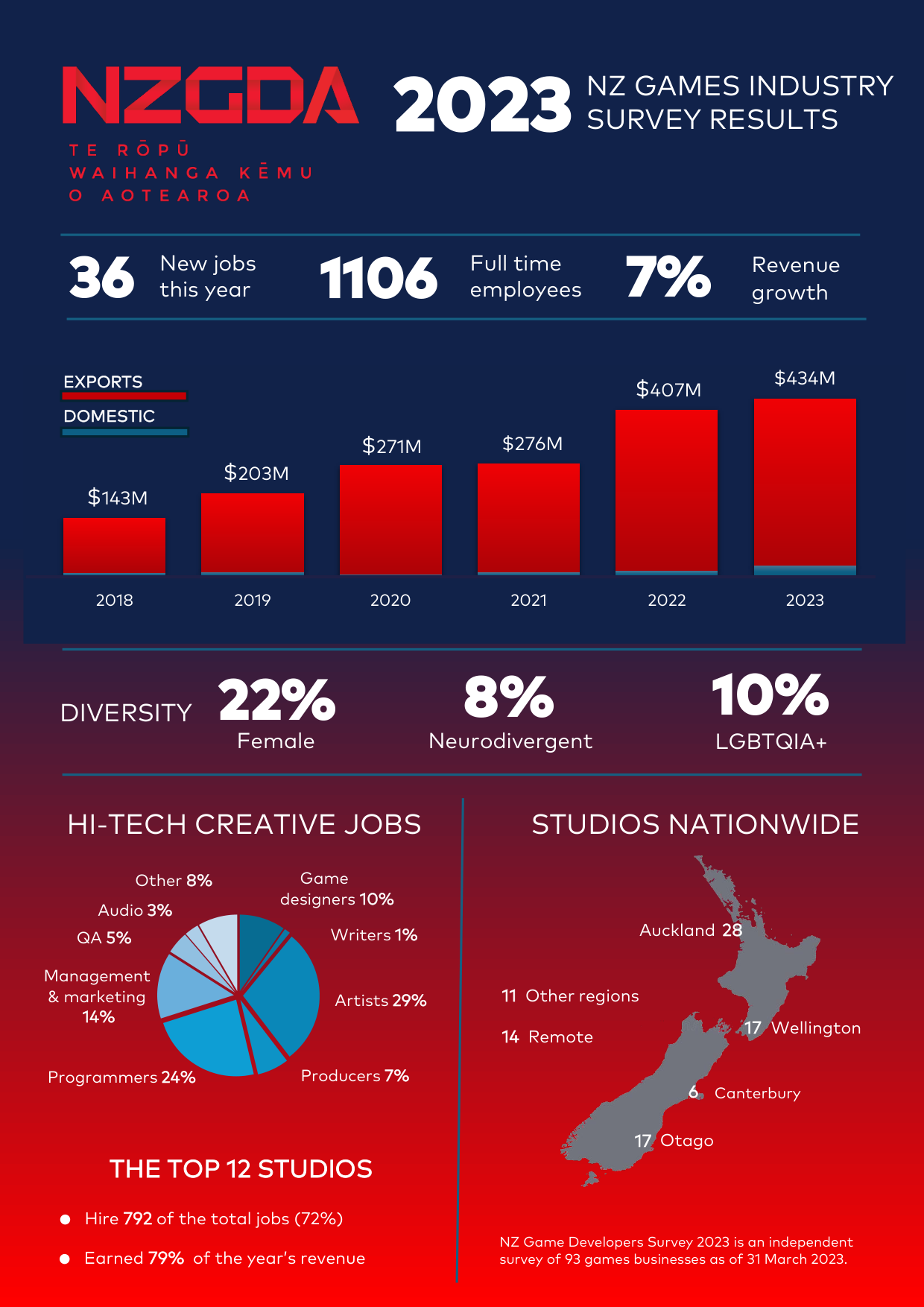

New Zealand video game studios earned $434.4m in the year to 31 March 2023, of which 95% came from high-value digital exports, according to a survey by the NZ Game Developers Association.

However, fierce competition from Australian tax incentives and the end of an entertainment boom during lockdowns saw the sector’s revenue grow by only 7% last year, compared to 47% growth in the previous year. The industry had been growing 26% on average for the last five years.

New Zealand Game Developers Association Chairperson Carl Leducq says the results clearly show the impact that Australian federal and state tax incentives had on New Zealand’s industry over the last two years. “Australia’s tax incentives deeply affected our industry over the past two years, constraining our studios in the battle for talent and curbing growth,” says Leducq. “However, the commitment to the New Zealand Game Development Sector Rebate means the sector’s strong growth will resume. Our studios have stood strong amidst these challenges, and I am certain of their resilience and potential for future success.”

In response to the Australian incentives, the New Zealand Government introduced the Game Development Sector Rebate in this year’s Budget, which local video game businesses will be able to claim next year, covering the current financial year ending 31 March 2024.

Game studios report that poaching from Australia severely limited their hiring last year and many studios would have hired more people if they could. The 93 businesses surveyed employed 1106 equivalent full time employees, similar to the 1070 people employed a year earlier. However, studios are now more positive about their hiring intentions and 51% of studios say they plan to hire additional staff in the year ahead.

The video games sector continues to be one of New Zealand’s most productive export sectors, with average earnings per worker of over $392,000. 95% of revenue came from digital exports.

Leducq is optimistic the industry will return to its high growth rates. “We don’t expect to see the New Zealand rebate’s impact reflected in our revenues until it comes into effect in a year or two, but already it has ignited a new wave of interest and investment by developers.”

82% of the games studios surveyed were locally owned and operated, and almost half (43%) were founded in the last three years. Most (74%) develop their own Intellectual property rather than doing contracts for other people. This growth has been supported by the activities of the Dunedin-based Centre of Digital Excellence (CODE), which provides training and grants for games startups.

A stand-out hit game this year was Dredge by Black Salt Games in Ōtautahi, Christchurch. Developed by a team of four, this sinister fishing adventure garnered over one million sales globally, was nominated for Indie Game of the Year at The Game Awards, and was featured in best games of the year lists by Time magazine and NME.

“Successes like this show that regardless of industry challenges we continue to bat above our weight here in Aotearoa and can deliver high-end and engaging experiences to the masses,” says Leducq.

Skills shortages, including a lack of hiring diversity, remain a potential constraint on the sector’s growth.35% of studios find it challenging to recruit qualified programmers, especially those with experience. 20% find it challenging to recruit 3D artists or animators.

Only 22% of game developers identified as female, 65% as male, 3% as neither male or female, although 10% had no response about their gender. The representation of Maori has grown from 2% of the workforce in the last survey to 5% this year. 8% of people working in the games industry identified as being neurodivergent, 10% identified as LGBTQI+, and 2% as having a disability.

The NZ Game Developers Survey 2023 is an independent survey of 93 games businesses conducted by Premium Research. Figures are as of 31 March 2023.

Full Survey Data

Export Earnings

Job Creation

|

|

Video Game Businesses

- 82% of all NZ games studios are owned and operated locally.

- Almost half (43%) of all active game studios in NZ were established in the last three years.

- The businesses are mostly independent, with 74% of studios developing their own Intellectual property.

- Of the industry’s $434 million of earnings, 82% came from direct consumer sales, 4% from investment/crowdfunding, 3% from advertising and 3% from contracting services.

- 59% of studios predict slight or significant growth in the coming financial year. 30% believe they will maintain current revenues.

- PC stands strong as the dominant platform with 50 studios (54%) receiving revenue from them and mobile next with 29 studios (31%). More studios earned revenue from Virtual Reality or Augmented Reality (17%) than Consoles (16%).

- New Zealand games are sold around the world. 44% of studios earn a significant portion of their income from the USA, 34% from Europe, 12% from China, 9% from the rest of Asia, 6% from Australia. Only 54% of studios say they earn more than 10% of their total income from New Zealand.

- 36% of studios were based in Auckland, 18% in Otago, 18% in the Wellington region, 6% in Canterbury, 4% in Waikato, 3% in Bay of Plenty, 1% in Hawkes Bay. 15% described themselves as remote studios with teams around the country and overseas.

- As is to be expected, the 12 largest studios employ the majority of our professional game developers. They employed 792 full time equivalent people (72% of the workforce) and earned 79% of the industry’s revenue.

Skills

- The most common jobs are Artists, who make up 317 (29%) of the total 1106 jobs, followed by Programmers with 263 roles (24%). Management, administration and marketing make up 14% with 154 FTEs, leaving the rest of the roles all under 10%

- Of the 337 expected job vacancies in the next year, 36% are for artists, 29% are for programmers, 11% are for management roles, 5% for producers and 4% for game designers.

- However, there are still skill shortages with 35% of studios finding it challenging to recruit qualified programmers, especially those with experience. 20% find it challenging to recruit 3D artists or animators.

- 25% of studios said they had hired graduates in the last year, as did 58% of the 12 largest games studios. 31% of studios said they hired people from other gaming studios, 21% from other creative sectors, 19% from overseas, 13% from other ICT jobs and 14% from general business.

- 90 employees or 8% of the industry are on work supported visas.

Diversity

- 22% of game developers identified as female, 65% as male, 3% as neither male or female. However, 10% had no response about their gender.

- The representation of Maori has grown from 2% of the workforce in the last survey to 5% (52) this year. The most common ethnicity remains NZ European/Pakeha with 38%. However, 33% of the workforce had no response about their ethnicity.

- 8% of people working in the games industry identified as being neurodivergent, 10% identified as LGBTQI+, and 2% as having a disability.

- 28% of senior leaders in game studios identified as female, 15% as LGBTQI+, 16% as neurodivergent, 8% as Māori, 3% as Pacific, and 5% as disabled.

The NZ Game Developers Survey 2023 is an independent survey of 93 games businesses conducted by Premium Research. Figures are as of 31 March 2023.