NZ Interactive Games 2021 Survey Results

9 December 2021

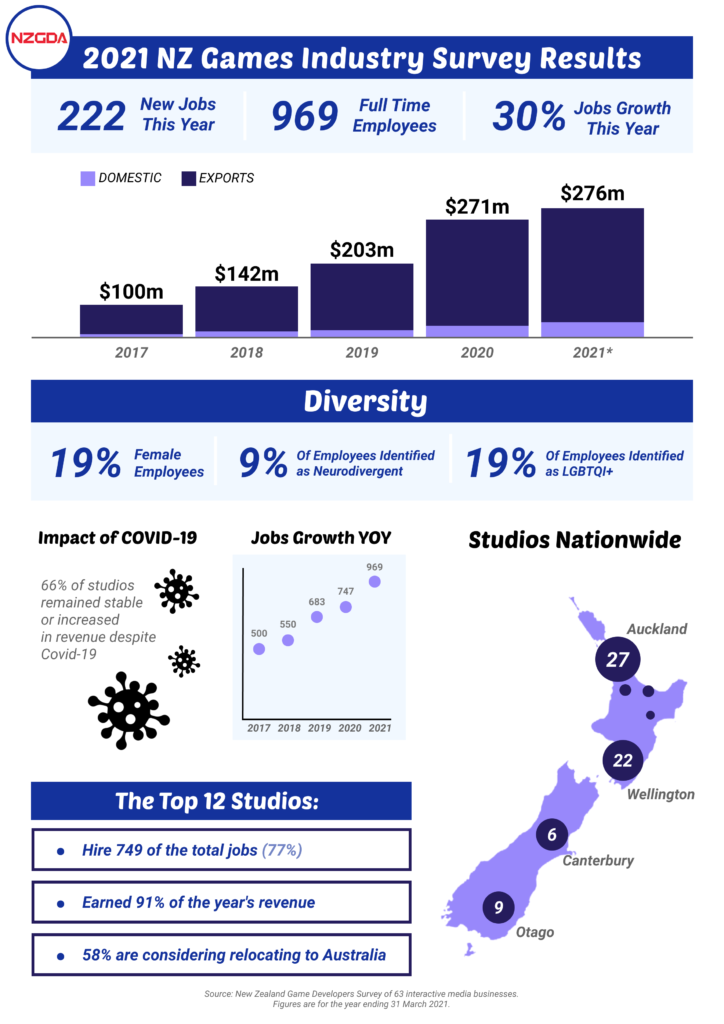

New Zealand game studios created over 200 jobs during lockdown

But Australian tax incentives and border restrictions put 300 more jobs at risk, according to latest survey findings.

New Zealand’s video games industry created 222 new jobs during 2020’s lockdowns. While the industry grew employment 30%, the potential to create over 300 future jobs is at risk from an aggressive Australian tax incentive targeting the industry and covid-19 border restrictions.

The number of people employed in the industry increased by 222 jobs to 969 full time equivalent jobs, an increase of 30% on the previous year. New Zealand studios estimate they will have 331 more job vacancies in the coming year, but are worried that they won’t be able to fill them.

“While our local industry has been on a clear trajectory of growth and global success, the continuation of that is not guaranteed. While Australia’s tax incentives will undoubtedly lure overseas studios to relocate there, New Zealand’s potential lies in the creation of our own intellectual property. Investing in growing and exporting that IP differentiates our strategy from our neighbour’s and holds the key to exponential revenue growth.

There are further challenges created by the continuation of closed borders for a country that had increasingly relied on importing experienced tech talent from overseas, so it’s worrying, but unsurprising, to hear that some New Zealand studios are looking at expanding into Australia instead of expanding locally.”

Revenue

New Zealand interactive media and video games studios earned $276 million in the FY2021 financial year. 97% of the sector’s revenue came from exports of weightless digital products or services. This highly scalable and weightless nature means their potential to generate accelerated growth can translate into an immediate increase in high-quality jobs and export revenue, and with minimal impact to national climate change objectives.

Overall, industry earnings were similar to the previous year’s revenue of $271 million. While global games audiences boomed during lockdown, New Zealand businesses were hit by the US Dollar exchange rates which grew by 19% during the period of the survey.

Global Competitiveness

Worth over $250 billion annually, video games are the largest sector of the entertainment industry worldwide New Zealand is already home to established and globally successful studios, with the largest studios an average of 12 years old. The 12 largest studios earned 91% of the year’s revenue, and they employed 77% of the workforce.

However, of those top 12 studios (accounting for 749 jobs), 58% said that they were considering relocating some of their operations to Australia to take advantage of their incentive programme. If even half of these relocations take place in 2022, it would be a huge loss to New Zealand in what should continue to be one of our most productive and fastest-growing digital sectors. In terms of productivity, the sector earned $285,000 per employee. This brings the industry’s average compound annual growth rate (CGAR) since 2014 to 34% per annum.

The potential of such continued growth creates benefits across New Zealand, as digital businesses can – and increasingly are – based in regions as much as main centres. They are also in constant need of skills, with the median salary being around twice the national equivalent.

Opportunities and Challenges

331 new jobs are predicted by studio owners for 2022, should New Zealand manage to navigate the neighbouring tax incentive risks. In particular, studios are looking to hire over 150 new artists and visual effects technicians. 47% of the planned hires in the next year are for artists, whereas last year only 25% of vacancies were for artists.

Game development relies on talent in almost all creative disciplines, from screen and visual arts, to music and sound, and writing and design. The making of games then holds obvious crossover with the film industry, where technical tools are also on the rise, as evidenced by the recent purchase of Weta Digital’s tool team by games engine Unity.

However, challenges remain for the growth potential of the New Zealand games industry. The top five business issues affecting games businesses were a shortage of experienced staff, covid-19 international travel, attracting early-stage development funding, attracting further investment and the readiness of graduates.

Existing issues that the New Zealand Game Developers Association already works to address, according to Rapp, and challenges which won’t be helped by additional changes on the horizon:

“For a sector like ours to grow, the businesses within it need to grow and be able to attract senior-level talent. The New Zealand games industry requires investment and skill development in order to support the creation and growth of small independent studios who can then develop more intellectual property and employ more New Zealanders. Support for the interactive media sector is paramount if we wish to remain competitive in this high-growth area.”

The figures quoted come from the annual New Zealand Game Developers Industry Survey.

Now in its 11th year 63 interactive, gaming, virtual reality, augmented reality and education tech companies contributed, up from 42 last year.

About Industry Skills

- Game developers employ a range of creative, technical and business roles, with 26% of the people in the industry working as programmers and 26% as artists. 11% are game designers, 9% are management, 7% are producers, 7% are quality assurance, 2% are audio, 1% are writers and 9% are other roles.

- Of the 331 new expected job vacancies in the next year, 47% are for artists and 20% are for programmers. However, this is also the area with the greatest skills shortages and 56% of studios say it is a challenge to recruit experienced programmers. Of the other planned new jobs, 9% are for game designers, 9% for management roles and 7% for producers.

- 30% of studios said they had hired graduates in the last year, as did 58% of the 12 largest games studios. 32% of studios said they hired people from other gaming studios, 27% from other creative sectors, 19% from overseas, 13% from other ICT jobs and 10% from general business.

- 128 employees or 13% of the industry are on work supported visas.

About Industry Diversity

- 19% of game developers identified as female, 65% as male, 1% as neither male or female, and 15% did not respond about their gender.

- 51% of game developers identified as Pakeha or New Zealand European. 13% identified as Asian, 3% as Māori, 1% as Pacific, 13% as other ethnicities, and 19% did not reply.

- 9% of people working in the games industry identified as being neurodivergent, 3% as having a disability and 19% as identifying as LGBTQI+.

About NZ Video Games Businesses

- Of the industry’s $276 million of earnings, 89% came from direct consumer sales, 4% from advertising and 4% from contracting services. Areas such as licensing revenue (less than 1%) were down on the previous year.

- In-game advertising revenue has declined from $27m in 2019 to $10m in 2020. This may be due to privacy changes Apple made that affect how mobile games target players and changes to mobile game certification requirements in China.

- 52% studios predict continued strong growth (greater than 10% this year). 17% predict some growth, 19% expect to maintain current revenues, 2% predict a slight decline and 10% expect a significant decrease.

- 43% of studios were based in Auckland, 22% in the Wellington region, 14% in Otago, 10% in Canterbury, 3% in Waikato, 3% in Bay of Plenty, 2% in Hawkes Bay and 4% elsewhere.

- Most games businesses are 8 years old on average, although 12 new startup studios were founded in the last year. 30% of the businesses surveyed have not launched their first game yet. Startup studios attracted $4.3m of investment during this year.

- 60% of studios are independent game developers focussing on creating their own projects and intellectual property, while 25% are contractors producing games for clients. 7% make virtual reality or augmented reality games and apps, and 5% focus on serious and educational games. (4% are other)

- 30% of the businesses surveyed have not launched their first game yet, and 30% have only published one game. 17% of studios have made more than 10 games.

- New Zealand games are sold around the world. 63% of studios earn a significant portion of their income from the USA, 49% from Europe, 13% from China, 8% from the rest of Asia, 6% from Asia. Only 40% of studios say they earn a significant part of their income from New Zealand.

- 48% of developers make games for PC and 53% make mobile or tablet games. Virtual reality and augmented reality continue to increase in popularity, with 24% studios having made VR apps and 14% have made AR apps. 17% studios make games for Mac, 16% for web and 13% for consoles.

For any questions regarding the survey results, please email info@nzgda.com