Update on the GDSR

28 June 2023

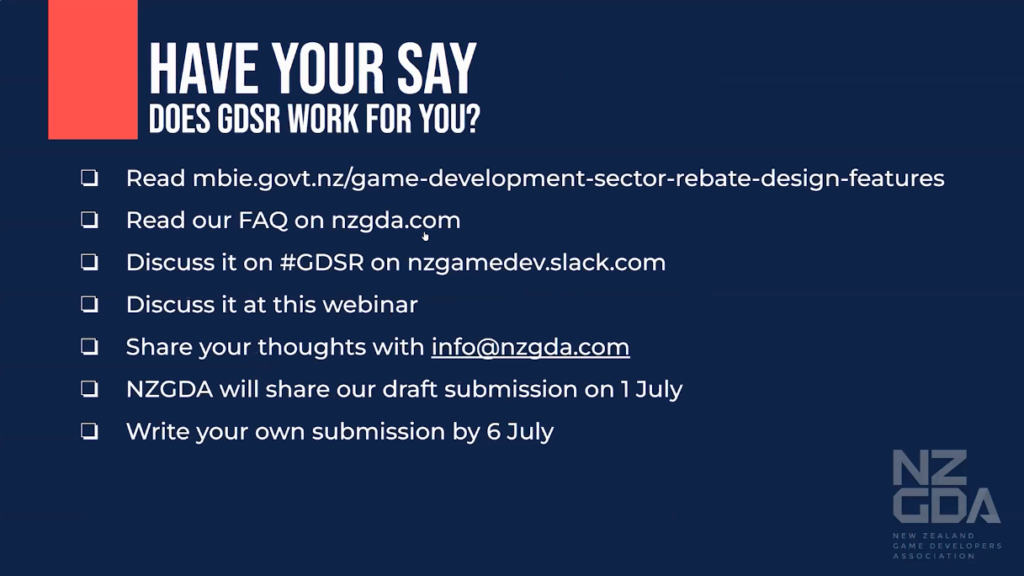

On 22 June we held a webinar for NZGDA members to discuss the incoming 20% Game Development Sector Rebate to help grow Aotearoa New Zealand’s interactive industry.

Watch the webinar here: https://youtu.be/AnJg4MSIqh8

Don’t forget to have your say on the Government’s rebate design by 6 July 2023. See mbie.govt.nz/game-development-sector-rebate-design-features

You can continue the discussion on #GDSR on nzgamedev.slack.com (https://join.slack.com/t/nzgamedev/shared_invite/zt-1xqd4y6ib-3OAg2obLuMrgcBOR7gI0GQ). The NZGDA Board will also share our draft submission with members before 6 July for comment.

Webinar Transcript Highlights

This edited transcript covers some of the discussion from the Zoom chat discussion that happened in parallel to the webinar discussion. The participants have been made anonymous and come from a range of people.

This transcript is provided to help people consider issues when making their own submissions on the rebate. If you disagree, please include that in your submission.

DISCLAIMER:

- These are NOT the official views of MBIE, NZ On Air, NZ Government or the NZGDA.

- This scheme is currently undergoing a public consultation process and changes are expected. No business or other decisions should be made based on this draft information

- The chat has been edited for brevity, grammar, confidentiality and order.

Overview

What is the Game Development Sector Rebate?

- It is a rebate for the New Zealand game development sector introduced by the New Zealand Government in Budget 2023.

- It is a rebate on eligible game development expenditures of eligible firms at a rate of 20%.

- The minimum qualifying expenditure per annum is $250,000 and each firm’s rebate payment will be capped at $3 million per annum.

- Eligible firms can count eligible expenditures from 1 April 2023.

- The Government has provided funding of $40 million per annum for delivering and administering a rebate for the game development sector.

For more details see mbie.govt.nz/game-development-sector-rebate-design-features

Is there a reason why it’s called a rebate rather a co-funding grant? The word Rebate implies everyone qualifies regardless of situation. Which isn’t the case here. Doesn’t a rebate imply it’s automatic and everyone qualifies? (A tax rebate for example)

Comments included:

- It is not a “tax rebate” but is just a plain “rebate.” This particular rebate has nothing to do with the NZ tax system.

- Considering it as “co-funding” is a good way of looking at it.

- Avoid calling it a “grant” – it can very quickly become a negative political football. “Grant” and “Subsidy” have connotations that it’s a handout, rather than a rebate on private sector investment. In the last three weeks the screen sector has just been successful in renaming the Screen Production Grant (SPG), the Screen Production Rebate for exactly this reason.

- It is because the government is paying back a portion of our costs. That is based on information that is verifiable and given to the government by us. A grant is given with lesser assurance.

- MBIE has confirmed that the rebate is not intended to be included as taxable income.

What exactly is a rebate?

A rebate is not a tax credit or tax offset. Rather, a rebate is a cash grant that you can apply for from the Government, after you have spent your own funds on eligible activity.

With a rebate, economic activity and jobs are encouraged first, and the Government only pays the 20% rebate for actual activity that can be proven to have happened (with an application or sometimes audit).

Will the amount I claim be deducted from my annual income tax?

No, this is not a tax credit. The amount you claim in your application form on 1 April each year will be assessed and then the rebate grant will be paid to you by 30th June each year.

Has there been an assessment of the current level of eligible expenditure? Would the $40m less admin expenses be sufficient?

In the first year at least, the NZGDA estimates $40m will easily cover applications and administration. However, we expect the sector to grow so review after year two may likely have to review the budget.

According to the NZ Game Developer Industry Survey, 74 companies had 1070 equivalent full-time employees as of 31 March 2022. If they had an average eligible expenditure of $100,000 per employee, and all were eligible for a 20% rebate then approximately $21.4m of claims would be made.

Eligible businesses

The Eligible businesses criteria says that the business must be primarily involved in developing digital games and qualifies that as deriving at least 75% of revenue from such activity.

There were many comments about the practicality of this requirement:

- On requiring 75% of revenue being from developing digital games activities – as this is looking to take a “whole business approach”, is this requirement necessary when the goal is to support studios/businesses making games, supporting and increasing skills development in that area, and developing new IP in this space? For a business looking at a diverse range of creative development spaces, this would end up pushing them to setup up their “game making” portion of the business as a separate business entity which feels like unnecessary overhead.

- Where a game studio is a vertical with a wider business (and less than 75% of the overall business), we want to be sure the game development area is eligible for the rebate

- Needing 75% of revenue coming from digital games would potentially rule out the digital portions of hybrid game business, this seems counterintuitive when supporting the digital portions should be eligible

- Good point, how would people suggest things be reframed bearing in mind that we probably want to avoid company’s rorting the system with the aim of growing the sector. I heard examples given around not including gamifying accounting software for example.

- I feel like the 75% may not need to be there. Considering there is also an assessment on projects individually to be eligible and a threshold that needs to be met of eligible expenditure, along with the option for businesses breaking off digital portions anyway. It feels like its almost unnecessary

- Building on that, if you are game development studio, but have drawn income from other sources to fund developing your first game, then technically you haven’t met that criteria of drawing your income from games

- Say I’m a digital ad agency who wants to get into games and am incubating a games team inside our larger business. Couldn’t I just set up a subsidiary company that is 100% game development to get around the more than 75% requirement?

| NZGDA Recommendation |

The NZGDA will recommend this requirement be removed in its entirety. |

Does a company need to produce ALL of the components of a game to be eligible? The document defines a digital game as being comprised of Content, Game Mechanics/Code, Player Participation. What about a video game art company, be them an asset business like ours or an art outsourcing company may only produce the Content for projects, and not the code or game design. Would they be eligible?

The consultation document says “Businesses may not claim expenditures for which another business has already claimed. For clarity, when contractors are engaged, any rebate claim should only be made at the top-most level, i.e. the owner of the project, not at the contractor level.”

Is there a cap on how much a companies income can be to be eligible? For example, if a company is wildly successful, making major bank every year, they won’t be eligible for this grant.

The rebate is based on how much a business spends in New Zealand, not how profitable it is. However, there is a cap on how much expenditure a company can claim.

Is there anything preventing a sole trader with a NZBN who earns over $250k claiming the rebate? NZD $250k is feasible in US salary terms.

If that sole trader is domiciled in New Zealand and supports a business that pays tax in New Zealand, then this business could be eligible.

The consultation document specifies “market-level remuneration paid through the PAYE system”, thus salaries that exceed New Zealand market-level rates may be flagged by the auditing body

Eligible games

Physical games are equally capable of delivering on these objectives as digital games are. Why the strict focus here on digital vs physical gaming?

The NZGDA has championed the value of weightless creative IP exports in all its forms to the Government, but in designing the rebate the Government has defined some boundaries. In general, international trade laws do not allow for subsidies for physical goods, but digital goods and services can be allowed.

| NZGDA Recommendation |

The NZGDA will recommend that digital components and activities that fall within the definitions of eligible expenditures should still be eligible for the rebate. |

The rebate stated games with gambling are not allowed and gave lootboxes as an example. However the government stated earlier that lootboxes are not considered gambling. Has the government changed its mind?

There were several comments about this point. The Department of Internal Affairs has previously said lootboxes are not gambling, many New Zealand made games feature random items, lootboxes are varied and hard-to-define, in-game items are typically not tradable for real money, the ambiguity around lootboxes doesn’t meet the consultation documents’s criteria of being “substantially compromised of gambling-like practices.” Lootboxes may be a poor example to use, but clear gambling services and apps should definitely be excluded.

Other comments:

- Linear with no or limited activity, what is the definition for limited activity it has not been specified? If a game is made for toddlers and they do simple gestures to progress a linear story how does this interactivity meet the threshold or not?

- The distinction between corporate training and educational could be fuzzy

| NZGDA Recommendation |

The NZGDA Board will recommend that the reference to lootboxes be removed. |

Eligible expenditure

Video game job titles are all over the place, are specific roles listed. For example if your a “Junior Collision Modeller” will that need to be changed to be in line with some sort of requirement ie “Junior Technical Artist”

Specific roles are not listed. Instead, eligible functions and tasks are listed. This aims to be more flexible.

Given that we’re small business owners and money is tight, we don’t pay ourselves market rates?

Presumably the market rate requirement is aimed at not over claiming on salaries above market rates but does not affect those paying salaries that fall below market rates..

What if someone is paid outside of PAYE? In our studio we are all paid outside of PAYE but we still pay every two weeks – would that disqualify us as a game studio?

This should be clarified. The intent is that contractor and sole traders should still pay some form of tax in New Zealand. Maybe they are a GST registered sole trader.

Why are Rent and similar Operating costs excluded? Other than employee costs, leases and office spaces costs are the next best way a studio can lay roots into NZ. That will also encourage studios to remain in NZ.

I feel like that incentives investing in devs and not the staff you need to support them, which is bad business?The NZGDA recommends submitting your perspectives on this issue to MBIE as a part of your individual submission.

Would a NZ dev/studio using a 3rd party service provider from outside of NZ be excluded from using this funding ?Any services done overseas and not “domiciled in New Zealand” are intended to be excluded.

Could it be feasible to include a small % on employees or independent contractors who are not domiciled in New Zealand at the time of the expenditure. Especially where this is a specialty skill and might help educate/grow/develop existing staff and raise NZ’s skill set. Maybe allow up to 10% of staff costs for non-NZ domiciled staff/contractors?

Any services done overseas and not “domiciled in New Zealand” are intended to be excluded.

Profit shares or bonuses are becoming more common, so it would be strange if the rebate results in lower rewards for workers if bonuses are a hard exclusion.

The NZGDA recommends submitting your perspectives on this issue to MBIE as a part of your individual submission. .

Application Process

If applications…must be submitted within 15 working days following the end of the eligibility period”, how does that allow for invoices raised during the period but not yet paid out, given that commonly happens up to a month later?

Applications would be on an accrual accounting basis, i.e. expenditure incurred and deductible within the accounting period.

What are the auditor statement and statutory declaration trying to achieve? I think the availability and cost of auditors will be a barrier for small to medium sized studios.

Comments on this included:

- Regarding the “statement of readiness”: who is supposed to create this? In one sentence, it appears to state that the business will, but in the next it seems to have to come from the auditor.

- If the purpose of having a statement of readiness is somehow to bridge the gap between having your accounts in order and having an audit completed, it seems contradictory to have to wait for an auditor’s time for the statement of readiness and for the audit.

The NZGDA recommends submitting your perspectives on this issue to MBIE as a part of your individual submission.

The current proposal states that rebate payments will be paid out once per year after the end of the financial year. Would it be impossible to do payments more frequently – such as once every 3 or 6 months?

This was raised by several studios.

Other comments on the application process:

- 15 working days is a very tight application window.

- Finally, the tight timeframe and the requirement to have a statutory declaration may come into conflict!

- If the fund is over-subscribed and paid out on a pro-rata basis, what does that do to developers who wish to borrow against the future rebate, as described in yesterday’s webinar on the Australian DGTO? Does it make it impossible?

- How flexible can NZ On Air be with regard to applications from edge case businesses?

The NZGDA recommends submitting your perspectives on this issue to MBIE as a part of your individual submission.

| NZGDA R ecommendation |

The NZGDA will recommend two changes to this requirement:

|